Life insurance can sound like one of those things you know you should probably get, but it’s easy to push aside—until it’s too late. While we all want to live long, healthy lives, life is unpredictable, and having a safety net is crucial. This article will walk you through the ins and outs of life insurance, helping you understand why it might be one of the best decisions you can make for your family. So, grab a coffee and let’s talk life insurance!

Life insurance is a contract where the insurer pays the beneficiaries in exchange for premiums upon the policyholder’s death.

What is Life Insurance?

Life insurance is essentially a contract between you and an insurance company. You pay regular premiums (think of them as small payments) to the insurer, and in return, the insurer promises to pay a lump sum of money (called a death benefit) to your designated beneficiaries after you die. It’s designed to protect your loved ones financially in the event of your untimely death.

Sounds simple, right? But life insurance can come in many shapes and sizes, and choosing the right type can feel like a challenge.

Why Do You Need Life Insurance?

Let’s break it down:

- Family Protection: If you’re the main breadwinner or contribute significantly to your household’s income, what would happen if you were no longer around? A life insurance policy can help cover expenses like mortgage payments, college tuition, and day-to-day living costs for your family.

- Debt Coverage: Do you have debts—like a mortgage, student loans, or car payments—that would become someone else’s responsibility? A life insurance payout could help cover these liabilities, ensuring your loved ones aren’t left holding the bag.

- Funeral Costs: Funeral expenses can pile up quickly. The average funeral costs between $7,000 and $12,000. A life insurance policy can ease that burden on your loved ones.

- Estate Taxes: If your estate (everything you own) is large enough, it could be subject to estate taxes. Life insurance can help cover those taxes so your family doesn’t have to sell off assets to pay them.

Types of Life Insurance

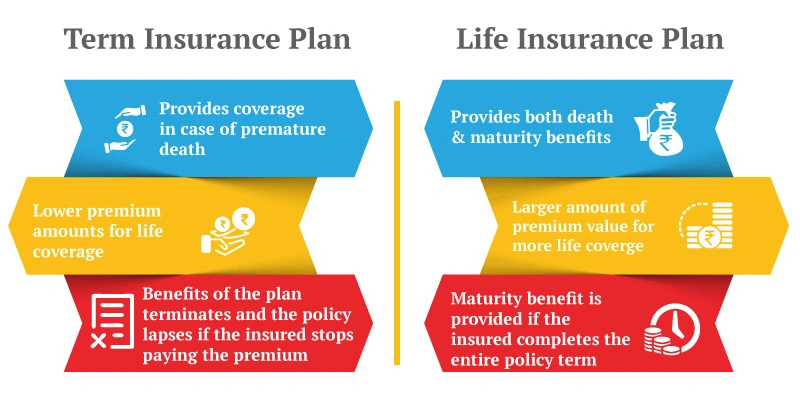

There are two main types of life insurance, each with its own pros and cons.

1. Term Life Insurance

This is the simplest and most affordable option. You choose how long you want the coverage to last (the “term”), which could be 10, 20, or 30 years. If you pass away during the term, your beneficiaries get the payout. If you outlive the term, the policy simply expires, and there’s no payout or refund.

Advantages:

- Affordable

- Great for covering temporary needs, like a mortgage or college costs

Disadvantages:

- No payout if you outlive the term

- Premiums increase if you renew after the term ends

2. Whole Life Insurance

This is a type of permanent life insurance that lasts your entire life, as long as you continue to pay the premiums. Not only does it provide a death benefit, but it also builds “cash value” over time, which you can borrow against or withdraw in some cases.

Advantages:

- Lifelong coverage

- Cash value that can grow over time

Disadvantages:

- More expensive than term life

- Can be complicated due to the cash value component

How Much Life Insurance Do You Need?

This is the big question. The answer depends on your specific situation, but a general rule of thumb is to get coverage that’s 5 to 10 times your annual income. Here’s what you should consider:

- Your income: How much money do your loved ones rely on from you each year?

- Debts: How much debt would your family need to cover (mortgage, loans, etc.)?

- Future expenses: Consider any future expenses like your children’s education or a spouse’s retirement needs.

- Funeral costs: Make sure to factor in the costs of your funeral and final expenses.

Life Insurance Premiums: What Determines the Cost?

Your life insurance premium (the amount you pay for coverage) is based on a few key factors. Here’s a breakdown of what influences the cost:

- Age: The younger you are when you buy a policy, the lower your premiums will be.

- Health: If you’re in good health, your premiums will be lower. Smokers and people with health conditions can expect to pay more.

- Occupation: If your job is considered high-risk (like being a firefighter or pilot), your premiums could be higher.

- Policy Type: Whole life insurance tends to be more expensive than term life due to its cash value component.

The History of Life Insurance

Believe it or not, life insurance has been around for thousands of years. The concept can be traced back to ancient Rome, where soldiers paid into burial clubs to ensure proper funerals for fallen comrades.

- 17th Century: The first life insurance policy as we know it was sold in 1706 in England.

- 19th Century: Life insurance gained traction in the U.S. after the Civil War when people started to understand its importance for families.

- Today: Life insurance has evolved with new types of policies, riders (extra benefits), and flexible terms to meet modern needs.

Common Life Insurance Riders

A “rider” is an add-on to your life insurance policy that provides additional benefits or flexibility. Some popular riders include:

- Accidental Death Benefit: Pays an extra benefit if you die in an accident.

- Waiver of Premium: If you become disabled and can’t work, this rider waives your life insurance premiums.

- Child Term Rider: Provides life insurance coverage for your children under your policy.

These riders allow you to customize your policy to meet specific needs or concerns.

Common Myths About Life Insurance

When it comes to life insurance, there are a lot of myths and misconceptions floating around. These myths can cause people to delay buying a policy or avoid it altogether, leaving their families unprotected. Let’s bust some of the most common myths about life insurance:

Myth #1: Life Insurance is Only for Older People

Many people believe that life insurance is something you only need to think about once you’re older or have health issues. However, the truth is, life insurance is often cheaper when you’re young and healthy. The younger you are when you buy a policy, the lower your premiums will likely be. Locking in a policy early can save you money in the long run.

Myth #2: Life Insurance is Too Expensive

A common reason people avoid life insurance is the belief that it’s too expensive. But in reality, term life insurance can be quite affordable—especially if you’re young and healthy. Many people overestimate the cost of life insurance by up to 300%! In fact, for a healthy 30-year-old, a 20-year term life policy with $500,000 in coverage can cost as little as $20-30 a month.Myth #3: I Don’t Need Life Insurance if I’m Single and Have No Kids

Even if you’re single with no dependents, life insurance can still be valuable. If you have any debts, such as student loans, or if you want to cover your funeral expenses so that your loved ones aren’t burdened with the costs, life insurance can provide peace of mind. Plus, you may want to lock in a lower premium now for the future when your life situation changes.

Myth #4: My Employer-Provided Life Insurance is Enough

Many companies offer life insurance as part of their employee benefits, which is great, but it’s often not enough coverage. Employer-provided policies typically cover one or two times your annual salary, which may not be sufficient to support your family long-term. Additionally, if you leave your job, you may lose the coverage. It’s wise to have a personal policy as well.

Myth #5: Stay-at-Home Parents Don’t Need Life Insurance

The role of a stay-at-home parent is incredibly valuable. If something were to happen to them, the surviving parent would likely need to pay for services such as childcare, cleaning, and even cooking. Life insurance can help cover these unexpected costs and ensure that the family maintains financial stability during a difficult time.

Myth #6: It’s Difficult to Get Life Insurance with Pre-existing Conditions

While certain health conditions can make life insurance more expensive, it’s a myth that you can’t get coverage at all. Many insurance companies offer policies for individuals with pre-existing conditions, and some policies don’t require a medical exam. The key is to shop around and find a provider that caters to your specific situation.

Myth #7: Once You Buy Life Insurance, You Can Set It and Forget It

Your life insurance needs will likely change as your life evolves. For example, you may need more coverage after getting married, having kids, or buying a home. It’s important to review your policy periodically to make sure it still meets your needs, and make adjustments as necessary.

Famous and Trustable Life Insurance Companies

Choosing a life insurance provider can feel overwhelming because there are so many options out there. To make it easier, here’s a list of some well-known and trustworthy life insurance companies that have earned a reputation for reliability, customer service, and financial strength.

1. New York Life Insurance Company

Founded: 1845

Headquarters: New York, NY

New York Life is one of the oldest and most reputable life insurance companies in the U.S. They offer a wide range of life insurance products, including term, whole, and universal life policies. New York Life is known for its strong financial ratings and excellent customer service.

2. Northwestern Mutual

Founded: 1857

Headquarters: Milwaukee, WI

Northwestern Mutual is another highly rated life insurance provider with a long history. They are known for offering personalized financial advice along with a variety of life insurance products, such as term, whole life, and universal life. They also offer financial planning services for retirement and investments.

3. State Farm

Founded: 1922

Headquarters: Bloomington, IL

While State Farm is often associated with auto and home insurance, they also have a strong presence in the life insurance market. They offer both term and whole life insurance policies with flexible options. State Farm is praised for its local agents, making the process of getting life insurance more personal and accessible.

4. Prudential Financial

Founded: 1875

Headquarters: Newark, NJ

Prudential is a global leader in the life insurance industry, offering a wide range of products including term, whole, and universal life insurance. They are known for their financial strength and offer policies with innovative features like living benefits, which allow you to access part of the death benefit while still alive in certain situations.

5. MassMutual (Massachusetts Mutual Life Insurance Company)

Founded: 1851

Headquarters: Springfield, MA

MassMutual offers a broad selection of life insurance products, from term life to permanent life insurance options. They are known for their strong customer service and financial planning tools. MassMutual also offers policies with cash value accumulation, which can help provide financial flexibility later in life.

6. Guardian Life Insurance

Founded: 1860

Headquarters: New York, NY

Guardian is a mutual company, meaning it is owned by its policyholders, which often translates into higher dividends for whole life insurance policyholders. They offer a range of life insurance products, including disability insurance, and are known for their solid customer service and flexible policy options.

7. Mutual of Omaha

Founded: 1909

Headquarters: Omaha, NE

Mutual of Omaha offers life insurance policies that range from affordable term policies to permanent options like whole and universal life insurance. They are known for their easy application process and flexible coverage options, making them a popular choice for people seeking straightforward life insurance.

8. AIG (American International Group)

Founded: 1919

Headquarters: New York, NY

AIG is a global insurance giant that offers both term and permanent life insurance policies. They are known for their competitive pricing, especially for term life insurance, and offer policies with various riders that allow you to customize coverage based on your needs.

9. Pacific Life

Founded: 1868

Headquarters: Newport Beach, CA

Pacific Life is known for offering both life insurance and annuities, with a focus on financial planning for retirement. They offer a range of life insurance options, including term, whole, and universal life. Pacific Life is frequently praised for its strong financial stability and customer service.

10. Lincoln Financial Group

Founded: 1905

Headquarters: Radnor, PA

Lincoln Financial offers a variety of life insurance options, including term, universal, and indexed universal life insurance. They are known for their flexible policies and strong focus on wealth management and retirement planning.

These companies are recognized not only for their financial strength but also for their customer satisfaction and long-standing histories in the industry. No matter your needs, one of these providers is likely to have a life insurance policy that fits your situation.

Choosing the Right Provider for You

When selecting a life insurance company, it’s important to consider a few key factors:

- Financial Stability: Check the financial ratings of the company (through agencies like A.M. Best or Moody’s) to ensure they’ll be around when your family needs the payout.

- Policy Options: Make sure the provider offers the type of policy you need (term, whole, etc.) and allows flexibility in coverage amounts and premiums.

- Customer Service: Read reviews and ask around to ensure the company has a reputation for good customer service and ease of handling claims.

- Riders and Flexibility: Some companies offer additional benefits or flexibility with riders, so make sure you understand what’s available.

Choosing the right life insurance company is a big decision, but it’s worth the peace of mind knowing your family will be taken care of when they need it most.

| Company | AM Best Rating | Coverage Capacity | Maximum Issue Age | Policies Offered |

|---|---|---|---|---|

| New York Life | A++ | Up to $10 million or more | 90 years | Term Life, Whole Life, Universal Life |

| Northwestern Mutual | A++ | Up to $10 million or more | 85 years | Term Life, Whole Life, Universal Life |

| State Farm | A++ | Up to $3 million | 85 years | Term Life, Whole Life |

| Prudential | A+ | Up to $25 million or more | 85 years | Term Life, Universal Life |

| MassMutual | A++ | Up to $10 million or more | 90 years | Term Life, Whole Life, Universal Life |

| Guardian Life | A++ | Up to $10 million or more | 90 years | Term Life, Whole Life, Universal Life |

| Mutual of Omaha | A+ | Up to $2 million | 85 years | Term Life, Whole Life, Universal Life |

| AIG (American International Group) | A | Up to $10 million or more | 80 years | Term Life, Universal Life |

| Pacific Life | A+ | Up to $15 million or more | 85 years | Term Life, Whole Life, Universal Life |

| Lincoln Financial Group | A+ | Up to $20 million or more | 85 years | Term Life, Universal Life, Indexed Universal Life |

FAQs About Life Insurance

1. Do I really need life insurance if I’m single? Yes, especially if you have debts like student loans or a mortgage. Someone could still be left responsible for those debts if you pass away. Plus, life insurance premiums are lower when you’re younger and healthier.

2. Can I have more than one life insurance policy? Yes, many people have more than one policy to cover different needs, like a term policy for a mortgage and a whole life policy for permanent coverage.

3. Can I get life insurance if I have a pre-existing condition? Yes, but your premiums may be higher depending on the condition. It’s best to shop around and compare rates.

4. What happens if I stop paying my life insurance premiums? For term life insurance, your policy will simply lapse, and you won’t have coverage. For whole life insurance, you may have options like using your policy’s cash value to cover the premiums, but this varies.

Conclusion

Life insurance may not be a fun topic to think about, but it’s one of the most important financial decisions you can make. Whether you’re just starting your career, raising a family, or planning for retirement, there’s a life insurance policy that can help protect your loved ones and provide peace of mind. The key is to understand your options and choose a policy that fits your needs and budget.

So, take the time to consider your life insurance needs today. Your future self—and your loved ones—will thank you.

For any info feel free and comment your query, or Contact us

Pingback: Travel Insurance- Your Ultimate Guide to Stress-Free Travels - Newsobjective.com